For the first post of this blog, I wanted to explore the question that inspired me to start the blog itself. In 2018 when I was offered the opportunity to opt-into the Blended Retirement System, or BRS, as a junior Captain I felt sure I was leaving the Army within 3 years. I spent hours on the Blended Retirement System Comparison Calculator. Now I am sitting at nearly 12 years of active service and have a wife, kid, and one on-the-way with no end to active federal service in sight.

If I do a full 20, what is the expected premium I will pay for the benefits of the BRS compared to the original High-3 pension? It requires some numbers heavy calculations that apply to my specific circumstances but I’ll look to expand the scope to be as general as possible.

Blended Retirement System, a History #

When the Blended Retirement System was introduced in 2018 nearly all service members qualified for what was known as the High-3 retirement. Your retirement benefit was a pension that you could qualify for after 20 years of service and was scaled based on the highest three years of your base pay. If you did not complete a full 20 years of service though, you got nothing. Serve for 18 years, no retirement benefit at all. Overwhelmingly, this affected Enlisted who are much more likely to serve one or two tours and not stay for a full 20 years.

To provide some retirement benefit to all Service members, the DoD provided matching up to 5% of a service member’s Thrift Savings Plan (TSP) under the BRS. That way, if you leave service before qualifying for a full pension you have a retirement benefit in the same way a 401k would work. In addition, each branch of the military could incentivize certain work roles using Continuation Pay which works like a bonus that is paid from the 8th to 12th year of service.

To compensate for this matching and continuation pay, the DoD decreased what’s known as the retirement multiplier. This multiplier is used when calculating the final monthly pension amount for each retiree. Under the Blended Retirement System, the retirement multiplier went from 2.5 to 2.0. Doesn’t seem like much, does it?

Starting in 2018, all new service members were enrolled under the new plan. Everyone already serving had several rounds of mandatory training and a choice whether to join the new system. After you switched there was no turning back. Government TSP matching began immediately after you switched to the new system.

The BRS & High-3 Retirement Systems Compared #

The value of the BRS is clearly in the favor of those not retiring with a full pension, but if you stay for a full 20 years, what is the premium you pay for the option of leaving early with some retirement benefit? That is, if you qualify for a full pension, how much money would you have if you didn’t switch?

In some ways the comparison is easy…

- Both provide access to Tricare health insurance as a retiree

- Both sets of VA benefits are equivalent

- Both allow full retirement at 20 years of active service

- Both provide annual Cost of Living Adjustments (COLA)

Three key differences separate the two systems…

- 2.0 vs 2.5 retirement pay multiplier

- Government TSP matching

- Continuation Pay

We will explore each of these factors to calculate the expected premium.

2.0 vs 2.5 Retirement Pay Multiplier #

As alluded earlier, the largest difference between the two systems is the 0.5 decrease in the retirement multiplier. This multiplier is used to scale the monthly pension amount based on years of service and your highest average pay.

Monthly Pension = Multiplier x Years of Service x Average(Highest 36 months)

BRS Example #

A practical example can help illustrate how this works.

20 Years x 2.0 BRS Multiplier = 40%

Final BRS Monthly Pension = 40% x $10,700 = $4,280

High-3 Example #

Contrast the above with the High-3 multiplier of 2.5.

20 Years x 2.5 High-3 Multiplier = 50%

Final High-3 Monthly Pension = 50% x $10,700 = $5,350

Taking the difference between these gives a monthly of $1,070 and annual premium of $12,840.

Each month I expect to receive $1,070 less in retirement under the BRS. Keep in mind that this value also rises each year with Cost of Living Adjustments. We can estimate the total value of this difference by calculating the cost of an annuity that conforms to the same contraints as the pension. This is it is tied to the life of the sole owner and increases annually to account for inflation. Fortunately the TSP website has an Annuity Calculator we can use.

Another way to phrase this question is “How much extra money in my TSP would I need in order to purchase an annuity that covers exactly the difference in monthly pension income?”

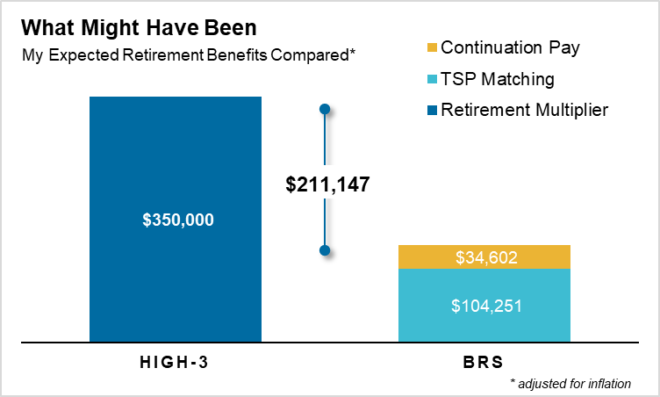

Using the TSP calculator above we reach an approximate $350,000 in required initial investment. That is, you would need an extra $350,000 in your TSP to make up the difference in the High-3 and BRS retirement multipliers.

Government TSP Matching #

Hold on! I hear you say, in the Blended Retirement System you now have what’s known as a defined contribution. That is, the Government will now match a portion of your contributions to your personal [TSP]. But how much does this offset the retirement multiplier?

Let’s calculate the expected future value of these contributions based on some general assumptions.

- We’ll assume a 6% inflation-adjusted annual growth of the portfolio

- Assume a 5% contribution to the TSP without any gaps

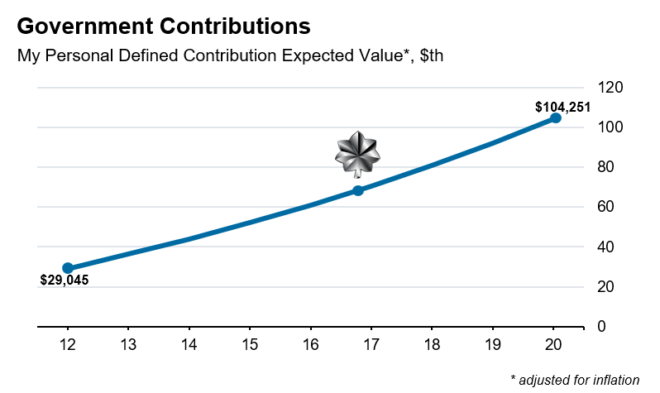

As of January 2024 my balance of Government matched contributions totals $29,045.31. That is the accumulated value of the total Government contributions and earnings on those contributions over the last 6 years.

If we pretend I get promoted to LTC in my primary zone we can project the value of Government matched contributions at the end of 20 years. This totals $104,251.25 in 2024 dollars.

Continuation Pay #

But wait! We’ve also got to account for Continuation Pay. Under BRS, each Service may incentivize a continued 4 years by paying a bonus to service members. This bonus is between 2.5 and 13 times the service members monthly base pay.

Since inception of the BRS this has stayed pegged at 2.5 (although the Marines have upped theirs to a full 5!). I am waiting on the 2024 rates but expect it to be the minimum for the Army.

6% growth over 8 years compounds to $34,602.77

Adding all these factors together leaves a final estimated premium at $211,147. In other words, I expect to be about 200K less wealthy when I reach retirement because I wanted the option to leave service with some amount of Government sponsored retirement money.

Premium for New Officers #

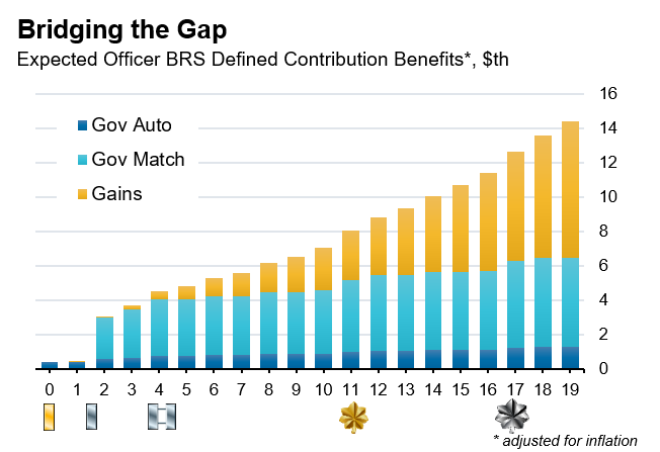

What about new Officers? Do they also still pay a premium under the BRS? If they contribute the full amount necessary for maximal matching under the same assumptions outlined above, would they still have more in the old High-3 plan?

The only changes necessary to compute this for Officers is to estimate the total expected value of the Government Matching contributions for each year of service under the BRS. You can see the estimated gains on the matched contributions begin to exceed the contributions themselves at approximately the 18th year of service. The full defined contribution benefit is a sum of the benefit each year. For the first two years this benefit is only the 1% match but starting in the 3rd year it would increase to a full 5% match.

Total Officer BRS Premium: $350,000-$147,055-$34,602 = $168,343

Yes, Officers still pay a premium, though they do not get a choice. We’ll look at Enlisted retirements in a separate post.

Closing Thoughts #

So what does that premium get you? Now you can leave service with at least a small amount of retirement benefit. The full retirement package looks mostly untouched and the money saved in TSP matching is not tied to the life of the service member. You can pass that on to your children in a way you could not easily do with a pension.

I do not regret opting into the Blended System, mostly because I still do not yet know for certain whether I will complete 20 years of service. Ask me again in 2032!

Thank you for reading and be sure to subscribe for future posts!