Have you ever pondered the magical figure appearing monthly on your Leave and Earnings Statement? Likely, you’ve observed its year-to-year fluctuations. The government provides this allowance for housing but what exactly is it supposed to cover? From where does it originate, and does it reflect market rates accurately? This post delves into the Basic Allowance for Housing (BAH), shedding light on what can be both an opaque and valuable benefit.

BAH Primer #

The Basic Allowance for Housing (BAH) is a tax-free benefit for service members, representing a portion of the costs for rent and utilities in specific housing markets near major military installations or metropolitan areas. It is not linked to mortgage rates. BAH, often the second-largest component of compensation after Basic Pay, varies by rank and is adjusted based on dependency status.

You might be surprised to discover BAH covers only a part of the anticipated rental costs in any given location. Presently, the Department of Defense (DOD) funds 95% of these expected costs, with the remaining 5% expected to come from the service member’s Basic Pay.

How BAH is Calculated #

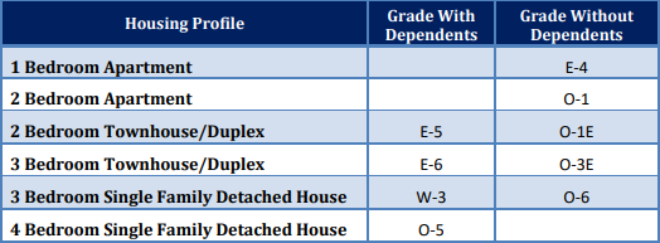

The DOD calculates BAH based on 6 distinct housing profiles for each Military Housing Area (MHA). These profiles are anchored to specific pay grades, serving as the basis for adjustments across other grades.

For instance, both a W-3 with dependents and a single O-6 are expected to receive a BAH that roughly covers the cost of renting a 3-Bedroom House in their MHA. Difficulties in finding suitable rentals within your BAH might stem from misaligned expectations regarding your housing profile.

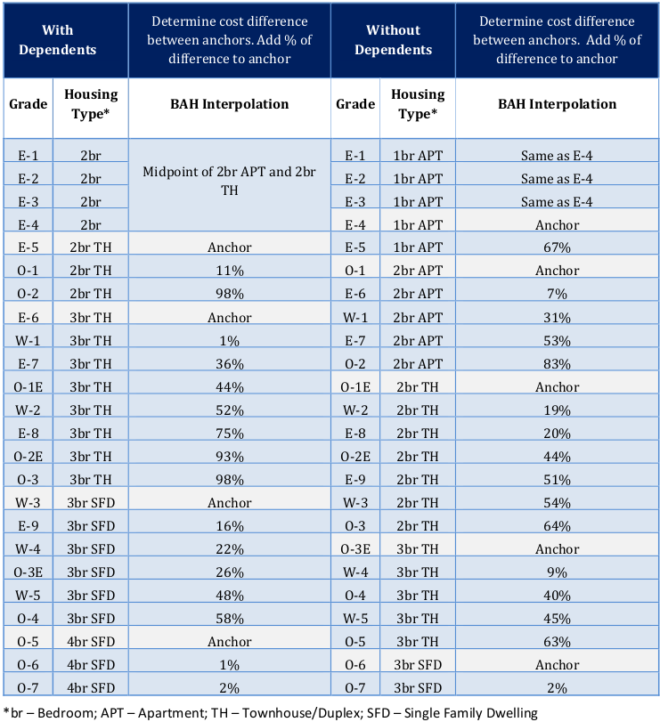

To illustrate how to apply these anchor points, we can use the following chart that includes an interpolation value for any given rank.

Calculating an expected BAH for an O-4 with dependents involves interpolating between the two nearest anchor points as follows.

Example O-5 with dependents Rate (Upper Anchor) = $4,000

O-4 Scalar = 58%

Adjusted Value = ($4,000 - $3,000) x 58% = $580

Example O-4 with dependents Rate = $3,580

How BAH Rates are Set #

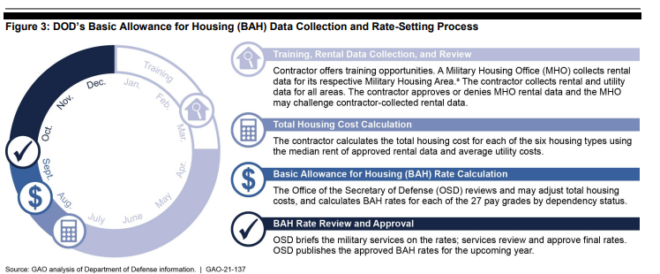

The DOD’s year-long process to estimate rental costs involves collaboration with local housing offices, real estate data, and contractors. This comprehensive data collection informs the total housing cost calculation, subsequently adjusted based on the expected contribution from service members.

Service Member Cost Sharing #

Historically, cost sharing for off-post housing has fluctuated. After estimating local housing costs, a portion of the national average is deducted from the final BAH rate, indicating the service member’s share. In the 90’s this was as much as 15% but as of 2024 is set to 5%. This approach ensures equitable financial responsibility across varying cost of living areas, though it may lead to lower coverage percentages in less expensive regions.

Problems with BAH #

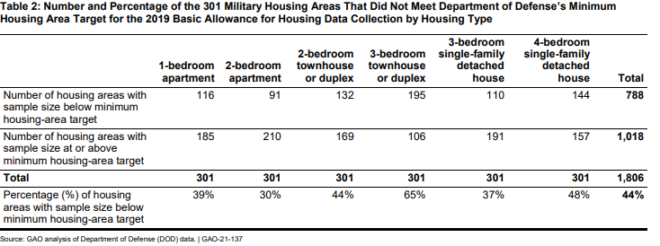

The DOD targets a 95% confidence level that its rent estimates are within 10% of the actual median. Despite aiming to sample 30-75 units per profile in each MHA, many areas fail to meet these data requirements, leading to outdated or inaccurate rate estimations.

These inaccuracies were highlighted in a Government Accountability Office (GAO) report on 2021.

As you can see, the Department of Defense (DOD) often struggles to meet the minimum sample size targets for rental housing data, leading to potential inaccuracies in BAH rates. This issue is exacerbated by the reliance on outdated or incomplete rental market data, which fails to accurately represent the true costs of housing across various locales.

This discrepancy often results in nearly half of all BAH rates lagging behind real market conditions, impacting service members’ housing searches!

Military Privatized Housing #

Since the 1990s, there’s been a shift towards privatized military housing, aiming to address maintenance backlogs and quality issues through private investment. However, controversies, including those highlighted by a 2019 Reuters investigation, have questioned the efficacy and integrity of this model.

I’ve lived on-post twice in my career. It can be exceptionally frustrating to see increases in BAH rate go directly to these companies with exactly zero increased value. Although I have not personally experienced an extended dispute with one of these companies I have seen several of my peers face significant ongoing maintenance issues that remain unresolved. A notable example was water that drained into the house light fixtures every time it rained!

Military Housing Privatization Compensation #

A lesser-known fact is that privatized housing entities receive direct compensation for the DOD’s cost-sharing program, effectively ensuring they receive the full market rate for housing.

As part of the NDAA in 2015 when cost-sharing was re-established these privatized housing companies lobbied to have the government cover any difference in BAH rate with the true rental market costs! That means not only do you give them your full BAH but they also get 5% of the national average as a kicker on top of that per-person!

Summary #

The Basic Allowance for Housing is a great, tax-free benefit for service members. Despite that, the process to achieve final rates can be convoluted and highly opaque. In this post we dove into how BAH aligns to housing profile anchors and how data for rental prices is collected and estimated. We also explored some of the challenges associated with accurate BAH rate calculations and the cost-sharing structure which forces service members to share some of the expected costs.

For more insight into topics like this, be sure to subscribe for future content!